Not Guaranteed: A Feature Not a Bug!

Fraser Stark

.26 Jul 2021

.When people first learn that the Longevity Pension Fund offers income for life, some naturally draw a parallel to lifetime annuities offered by insurance companies. The first question we often get, understandably, is “but, is that distribution rate guaranteed?”

In short: No, Longevity’s distribution levels are not fixed – but that represents one of its strongest design features. The trade-offs that would have been necessary to add a guarantee would have imposed real costs elsewhere, making the fund a less effective solution for retirement income, so we decided against that.

How Risk Fits into a Retirement Portfolio and How We Manage It

The monthly distribution levels are reviewed each year by the Risk Oversight team, with guidance from the Longevity Advisory Committee, using financial calculations to balance risk and fairness to all investors. They may be adjusted up or down, but the fund is designed and structured such that they should rise over time.*

By conservatively investing the fund’s assets in a balanced, low-volatility portfolio, and taking on some market risk, we can expect to generate modest returns in most years. And by not locking the distribution rate at a fixed level, we’re able to pass on those market gains to investors through higher distribution levels as time passes.

This structure also allows for investors (or their estates) to recover their unpaid capital. All of these features are incompatible with the guarantees offered on lifetime annuities.

Like everything in life, there are of course trade-offs. In return for these higher initial rates, expected future increases, and flexible structure, investors accept some market risk. But how many investors opt for the guaranteed security of their capital by burying cash in the backyard? (Or, perhaps more realistically, holding only GICs in their portfolio?)

The backyard burial would certainly provide a guarantee (ignoring the obvious risk of theft!), but at the very high cost of forgoing the gains expected from investing in the market. This risk is something nearly all investors accept and manage, and it should be no different when investing to generate retirement income.

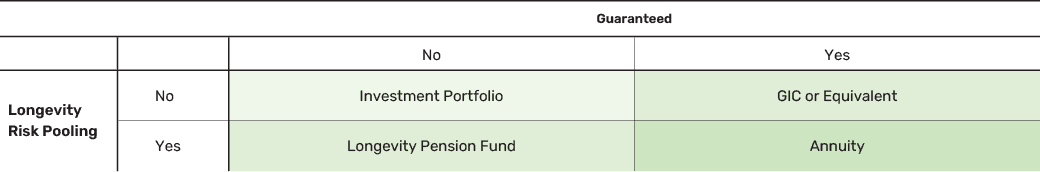

In the table below, we can think of a GIC or savings account as a guaranteed product for people saving for retirement, guaranteed to not drop in value, but unlikely to rise much either; an annuity is its counterpart with longevity risk pooling built in. On the other hand, a balanced investment portfolio is not guaranteed and accepts some market risk, and should therefore rise over time in most situations; the Longevity Pension Fund is its equivalent with longevity risk pooling built in.

“Guarantee” Does Not Mean “Risk Free”

In fact, it would be impossible to simultaneously guarantee payment levels to each investor, and at the same time guarantee the long-term sustainability of the overall fund.

Defined benefit pension plans can fail, and on occasion they have. Insurance companies can also falter, and some have – including AIG, who in 2008 needed an $85 billion bailout from the US Federal Reserve to avoid bankruptcy during the financial crisis. Because their obligations are fixed, there can be no firm guarantees that they can meet them all under any market conditions. This is not to suggest equivalence with these organizations, which are generally very stable, but rather to point out that there is always a degree of uncertainty present in some form.

The Longevity Pension Fund is not designed to eliminate all market risk; instead, it’s designed to help offset an individual’s longevity risk, by providing them with income for life.

Retirement expert Fred Vettese explored the potential trade-offs of different retirement product in various market scenarios and found that, according to his calculations, the Longevity Pension Fund outperforms a typical balanced fund or an annuity in a standard market scenario (50th percentile returns), showing the upside of Longevity’s product design. What’s more, he finds that in the extreme downside scenario (5th percentile returns), Longevity performs almost as well as the annuity and much better than the balance fund.

The next time someone says, “It’s guaranteed!”, ask yourself: “At what cost?” For some investors, the lower fixed rates on annuities could be the right choice. But for many others, the financial benefits of staying invested in the market far outweigh the costs.

With today’s low interest rate environment, along with Canadians’ increasing life expectancies, the Longevity Pension Fund can play an important role in maximizing a retiree’s lifetime income.

If you would like to learn more about Longevity Pension Fund and how to best implement it in your client’s or your personal retirement portfolio, please reach out: https://www.retirewithlongevity.com/contact

* Although distributions are designed to increase over time, they may go up or down. The level will be assessed regularly, and impacted by market conditions and unitholder redemptions (both voluntary and due to death). For individuals 64 years and younger, the starting annual income begins in the month after you turn 65 years old. The income payments shown are gross of taxes. Please review the prospectus or speak to your advisor for more details.

The Fund has a unique mutual fund structure. Most mutual funds redeem at their associated Net Asset Value (NAV). In contrast, redemptions in the decumulation class of the Fund (whether voluntary or at death) will occur at the lesser of NAV or the initial investment amount less any distributions received. Fees may apply.

Commissions, trailing commissions, management fees and expenses all may be associated with the Longevity Pension Fund. This communication is not investment advice, nor is it tailored to the needs or circumstances of any specific investor. Talk to your investment advisor to determine if the Longevity Pension Fund is suitable for you and always read the prospectus before investing. There can be no assurance that the full amount of your investment in a fund will be returned to you. Investments in the Fund are not guaranteed, investment values in the Fund change frequently and past performance may not be repeated.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters.